Here it is, my very first post for this blog! One of the reasons I created this site was to document my net worth every month. I figured by documenting this every month for the whole world to see I will hold myself more accountable for how I save and spend my money. My other intention, is the hopes that my net worth will increase each month and inspire others that they too can reach their financial goals.

I’ve never been a big fan of having to wake up and go to work everyday or having to rely on a job to pay the bills and survive. I recently graduated college this past December, and within the last month started my first full-time job and lets just say I don’t jump out of bed every morning excited about going to work. This encourages me to save more of what I earn so I can someday become financially independent.

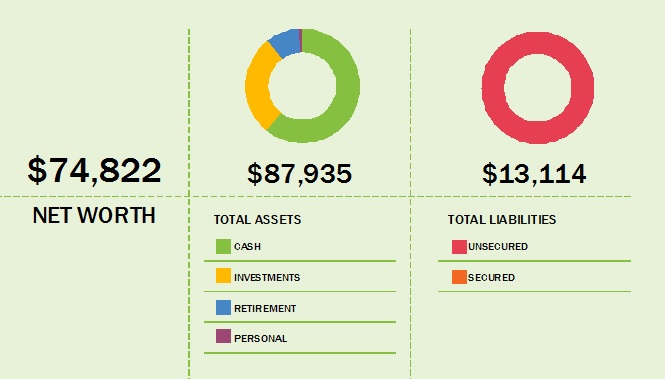

So here are the numbers for May…

My net worth this month was $74,822. This is the first time I’ve ever added up all of my assets and liabilities and I was actually surprised to see the net worth as high as it is.

Here’s how I came to this number…

Assets

Cash

Cash/Savings: $44,100

This is high for me. Normally I would have more invested in something with a higher yield, but because I’m saving to eventually buy a house and possibly a newer vehicle in the near future, I have a lot of my assets in cash.

Certificate of Deposit: $9,512

I opened this CD a little over a year ago and it matures in August. I’ll probably move this into higher yielding CD at maturity considering interest rates are a little better now than they were when I opened this.

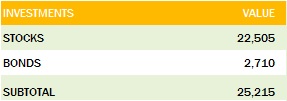

Investments

Stocks (Brokerage Account): $22,505

My brokerage account consists of individual stocks that I’ve picked myself. I’ve always enjoyed researching and buying shares of publicly traded companies.

Bonds: $2,710

All my bonds are Series EE Savings Bonds.

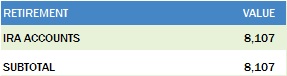

Retirement

IRA Account: $8,107

My IRA consists of a mix of bond and stock index funds. Now that I’ve graduate college and will be able to work full time, I plan on contributing the max contributions to this every year.

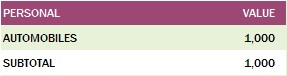

Personal

Automobile: $1000

My car, a beater, is actually valued on KBB at $1,650 but if I had to sell in I really don’t think I could get more than a $1000 for it. I’ve had this car for awhile (since I was 16) and hopefully it’ll last me for awhile longer.

Liabilities

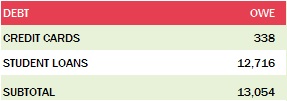

Debt

Credit Cards: $338

This month I racked up $338 on my cards. I pay these off in full every month, I only use credit cards for the rewards I receive from them.

Student Loans: $12,716

I’ve been trying to hammer away at these. When I first graduated college this past December, I had over $17,000 in outstanding student loans. The interest rates are pretty low, the highest one at 4.5%.

I got my first part-time job when I was 16 and since that time I’ve been trying to save as much money as I could. Until this past December I’ve always been a full-time student and believe it or not have never made more than $14,000 a year.

The numbers above are real and they prove that it’s possible to save money no matter how small your salary is. If you can manage to save a portion of each pay check and make smart investment moves you too can be on your way to financial independents.